Reconciling Your Credit Card in QuickBooks Online

When you reconcile your credit card you are comparing the entries in QuickBooks to the statement you receive from your bank.

It is very important to reconcile your credit card on a regular basis. When you reconcile to the credit card statement you can ensure that you have recorded all of the transactions on the statement, and recorded them only once!

If you are using the bank feed – theconnection from your bank to QuickBooks Online to bring in your transactions, you can compare the bank balance to the balance in QuickBooks. If these numbers are the same then likely you have captured all of the transactions. The reconciliation will take about 45 seconds – go ahead and do it anyway!

Be sure to have your credit card statement handy. We are checking entries from the bank’s statement to the entries in QuickBooks Online. This is very important.

You access the reconcile function three different ways:

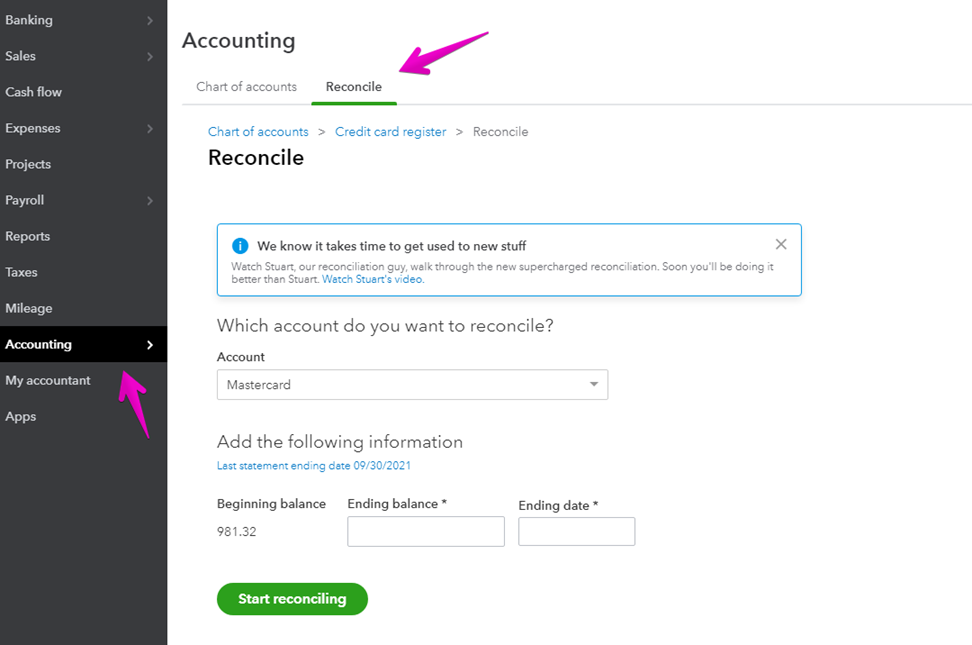

From the left hand tab:

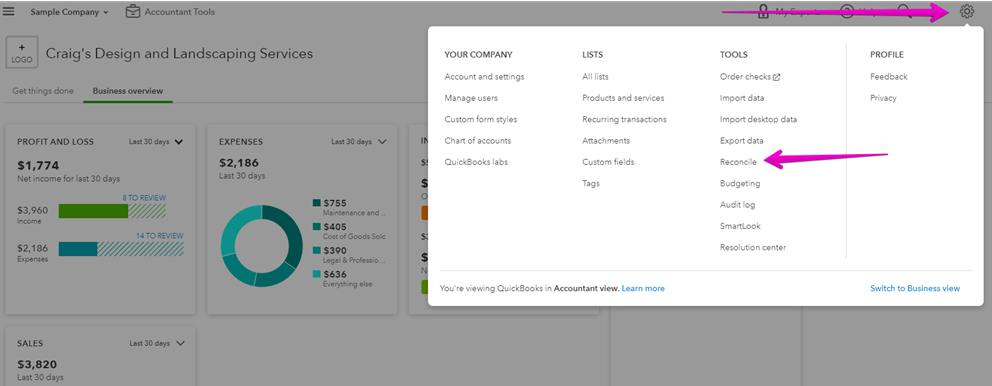

From the gear icon:

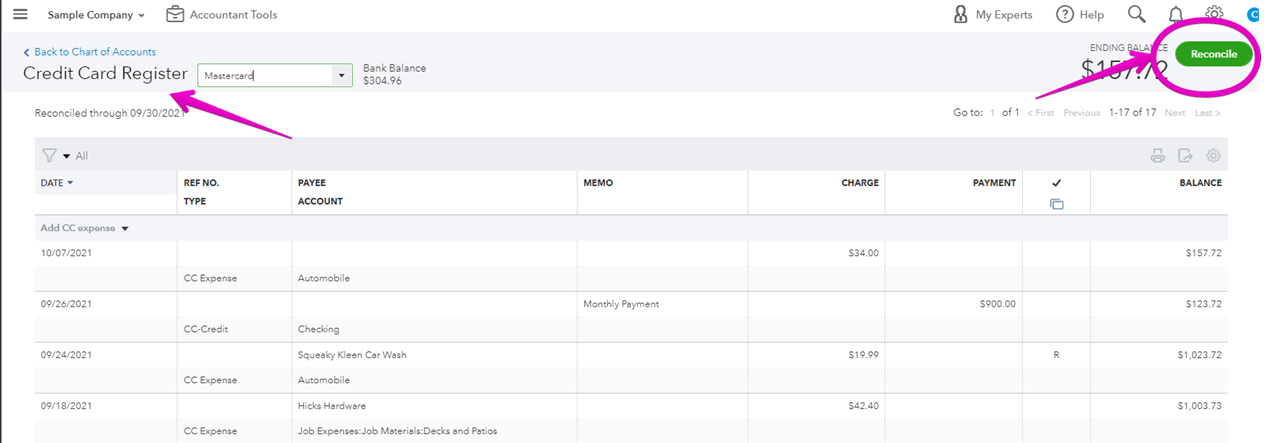

From the bank register:

Find your favourite!

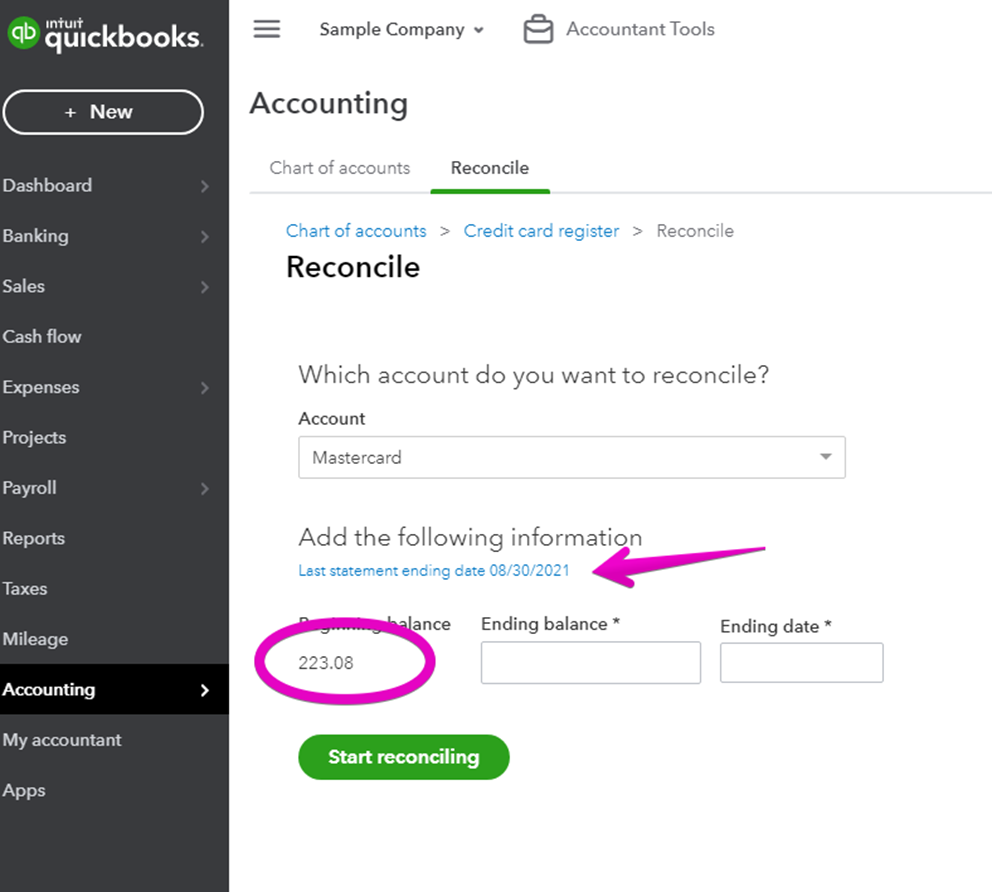

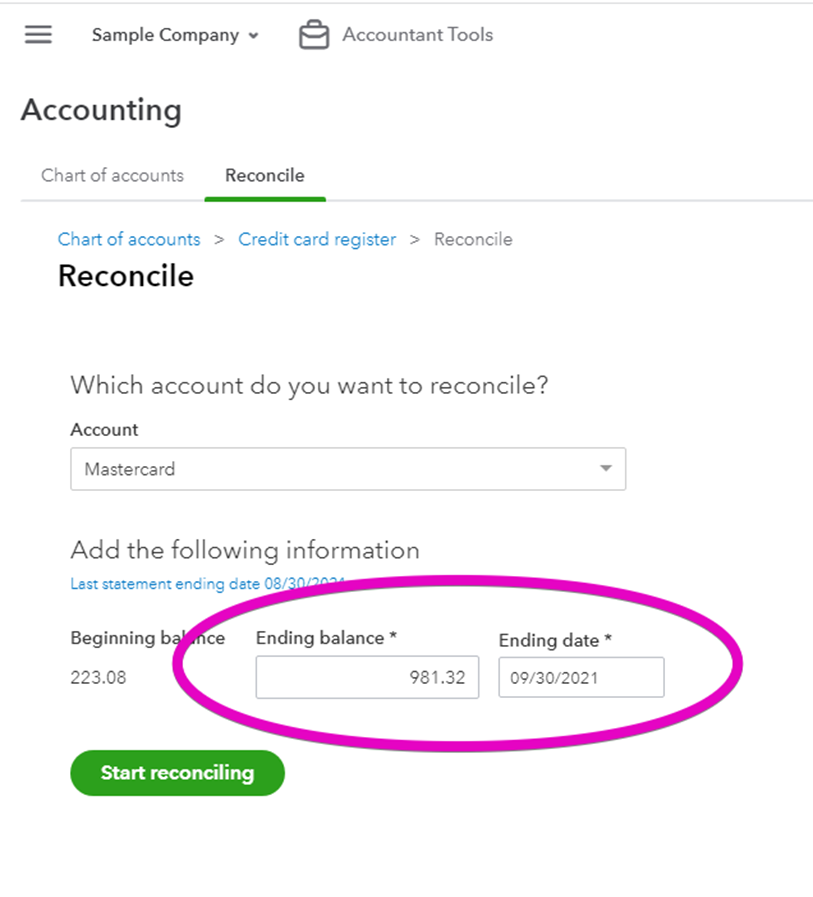

When you arrive at the reconcile pageselect the account you would like to reconcile and check that the beginning balance agrees to the opening balance on your credit card statement.

Enter the ending balance and date from your statement.

Let’s get started!

If all of the transactions have come from your bank feed, and everything is up to date, this could be the end of the exercise! If you have a difference of zero, and there are no unchecked transactions, congratulations!

If not, let’s look at what to do next!

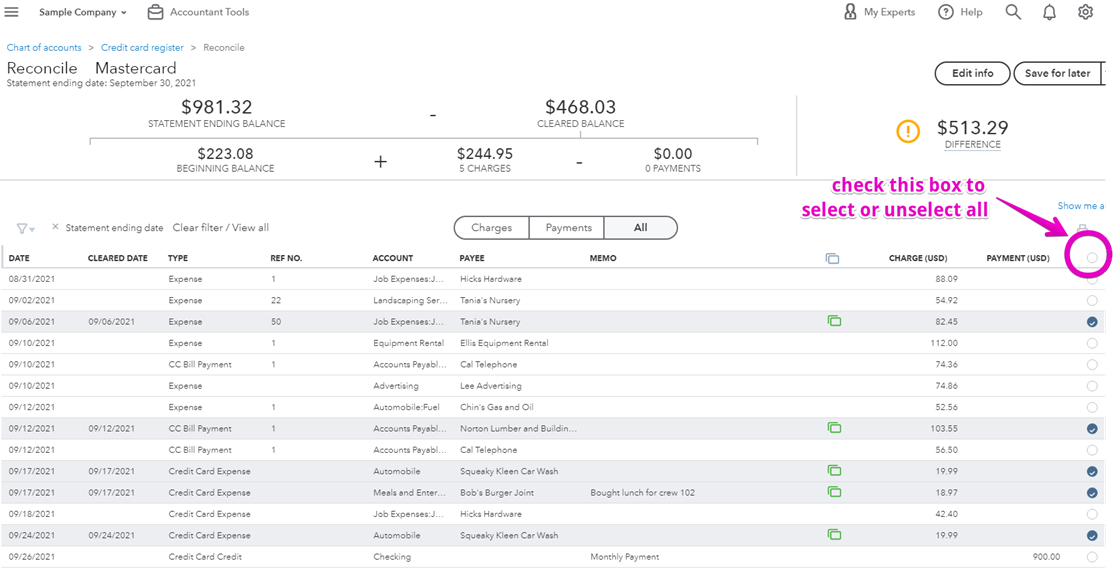

I begin by checking all of the transactions, and then unchecking all of the transactions so I have a clear slate to work with:

Working from the credit card statement to the bank feed check off each transaction until you have marked all from your statement.

If the numbers are different that means there are either transactions missing, or you have entered too many.

On occasion the bank connection may drop out, and you may not have captured all of the spending on your credit card. You can enter them now.

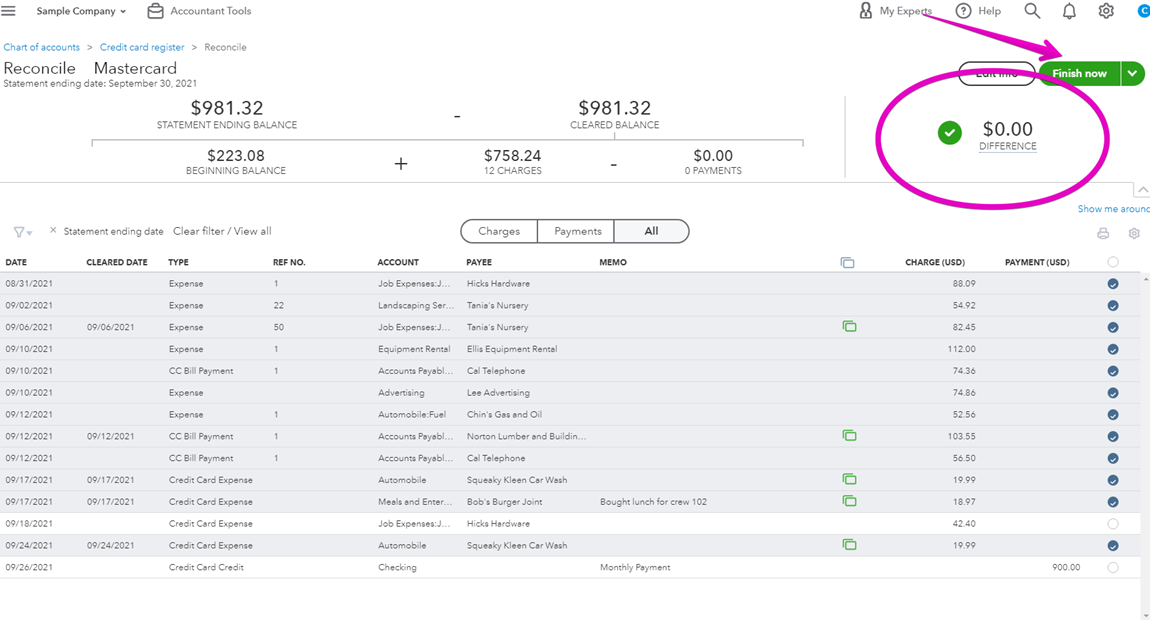

When you have a difference of zero you are not quite done!

Check to ensure that there are no old unreconciled transactions – these could be expenses that have entered twice. You should investigate all of them!

If you are using expense capture software such as the receipts function in QuickBooks Online, or Hubdoc or receipt bank, you may have recorded the expense in QuickBooks Online and then not correctly matched to the expense when it appears on the bank feed. This is the most common error I see. It is so common I have created a course just for finding and fixing duplicated transactions! If you find this has happened to you, check out the link below.

If everything is fine, you can click 'Finish now' and you have reconciled your account!

As I mentioned above, when you reconcile your credit card in QuickBooks Online you are able to determine if you have expenses missing, or expenses recorded twice.

Let’s stop for a minute and think about what that means…..

If you have recorded expenses twice, and you run your profit and loss or income statement it will look as though you have spent more money than you really have, and your profit will be lower than it should be. You won’t have accurate results to make decisions about your cash flow, or what it costs to manage your business on an on going basis.

On the other hand, if you have not recorded all of your expenses it will look as though you have spent less, and your profit is higher – you could spend money you don’t have, and you will not have a clear picture of what it costs to run your business.

Reconciling your credit card in QuickBooks Online on a regular basis is extremely important.

If all of your accounts are reconciled youwill have accurate information to manage your business and cash flow.

I have a couple of downloads that may help you – one is a checklist of things to do before you reconcile your bank account, and another is a month end checklist that will help you ensure your results are accurate before you use your reports to make important decisions. Links below!

— Finding and Fixing Duplicated Transactions in QuickBooks Online Course

— Bank Reconciliation Checklist

— Small Business Month-End Checklist

Still need help?

Check this out.

Reconciling Your Credit Card in QuickBooks Online

Why reconciling your credit card in QuickBooks Online on a regular basis is extremely important.

Let's go!Still need help?

Book a session! We can work together to solve your specific QuickBooks Online questions.

Let's go!Video transcript

Hi, Kerry here from My Cloud Bookkeeping, I work with small businesses and entrepreneurs to help them to keep their records in order using QuickBooks Online. So they can make their sales tax payments on time, understand their business, have reports that help them manage their cash flow or on a regular basis. And today we're going to talk about the really, really important function of reconciling. We're going to walk through the example of reconciling a credit card, but the same thing counts for reconciling your bank account. And what reconciling does is it make sure on a regular basis that your records agree to the bank's records. Now, what we're assuming is that what the bank has is correct, and we're comparing it into QuickBooks and that's very important. We don't want to be going the other way. So we're going to obtain a statement to compare to QuickBooks. Some of the reasons why the records might be different other than the bank error, we'll assume the bank has not made an error, is if you've added things from the bank feed—your connection to bank from the bank to QuickBooks twice, that happens a lot. I call them duplicated transactions. If you do have a problem with that, check the link below, it can be quite time-consuming to clean up and I've created a course to help with that.

So that can be one of the ways that things go wrong. Another thing is, if you're using expense capture software, such as Hubdoc or receipt bank, sometimes it comes in one way, and then you enter it another. So you've got something sitting here, it's unpaid, but you have an expense you've added here. Just things can get messed up. And when you're doing your reconciliation, as you'll see, when we move into the steps, you're able to select the items that are on the statement and see if there's anything leftover. Because, if you think about it, if you've added something from software and you've added it from your bank feed, it's going to be in twice. Your profit number won't be correct. Your expenses will look too high and you can't make good decisions because you don't actually know how much money you owe on that credit card. So let's have a look and walk through the steps now.

Before you reconcile, it's always important to make sure you've dealt with all of the items that are showing up on the bank feed. Because if you have things here that you have not yet recorded, obviously your records won't be complete, you won't have things to reconcile. I do have checklist. It'll be in the downloads, it's something about add-on steps to take before you do your reconciliation or something. Check that out.

So now that we're here, we have a number of different options to get to reconcile. We can click here and choose reconcile. We can pop up here and choose reconcile, or I don't know why this is my favourite, I always pop into the register and click reconcile here. So the first thing you're going to want to do is have a look at your statement and make sure that the beginning balance agrees. So this here is the statement balance from the 31st of July, it will be the opening balance on the statement you look at now. Now, often credit card statements They don't have a nice clean month, they may be to be the 5th of August to the 6th of September or something like that. But just make sure that whatever the beginning balance is, agrees to the opening balance on the statement that you're looking at. I hope that makes sense. So then you want to read the closing balance on the statement you have. So I've done that with my statement and mine is always also at the end of the month because it's not real, we're in the fake company. So I'm going to click ‘start reconciling’ and here's what's happened. It's popped in and it's decided that everything that's green here that's come from the bank feed is correct and everything that hasn't is not. And I can very easily see how to fix this $1,000 difference. I click this right here, but that doesn't really help us with our exercise because imagine if we've got, I don't know, 50 or 100 transactions here.

So I would be happy now if this was me, but if it was a larger exercise and I didn't really know what was going on, I would put a checkmark here. I would select everything. And then I'd put a checkmark here to unselect everything or de-select everything. The reason I do that is there could be items like this hiding on another page. So you might think you're starting clean, but you're not actually. So if you're going to got hrough the process where it doesn't agree, when you very first open this, then this is the way I would make sure I was doing that. So I would then look at my statement. I'm going to look at my statement and see the payment of $1,000. Not sure why that wasn't on the bank feed, but anyway, I'm looking at my statement and I'm seeing this one. I'm looking at my statement, I'm seeing this. Looking at my statement, seeing this. So notice we're going from the statement to QuickBooks, not the other way around. And here we go here.

Now, what do I have here? I have a credit card credit on the 30th of August that for some reason has not gone through yet. And then I have a purchase on the 31st of August. Now, when these items do show up on the bank feed, they should match. And it does make sense, perhaps this is a weekend and the items haven't been posted yet. Whatever you have unreconciled items, just, just look at them, do they make sense? Is it old? Like for example, if this, here was dated the 30th of July, I would treat it very differently. I would either be following up to see why I didn't get my credit, or I would be wondering if I've entered it twice or made a mistake. So anything that's white and hasn't been included in there, the reconciliation is normally, it's always something you want to consider why, and it might besomething that requires further action, but here it's just simply near the end of the statement date. If it doesn't clear next month, then I'll be concerned. Now, if you do have a lot of old white items there, it's important you do investigate them because they're making your results in accurate.

For example, here this $156 for utilities. If this never comes through on the credit card, then maybe I've recorded it twice and maybe it's $1,500. It could be anything and it's overstating your expenses. So anything that doesn't clear does need to be looked at, and that's extremely important. Some people get to zero here, and they're super excited. And then they have just lines and lines and lines of items are unreconciled and they're recorded as expenses, so their credit card balance is wrong, but also their expenses are incorrect. And I do have a course for finding and fixing duplicated transactions because it is the most common error I see. So if that's a problem for you, check that out, there should be a link below. And if you've got this all done and it's so beautiful, that's fantastic. You can click finish now, and it's all done.

So, as I mentioned earlier, there is a course for if you have doubled up transactions, which hopefully you don't. I also have some free downloads. There's a checklist of what to do before you do your reconciliation. I have some other things on matching from the bank feed.

So check out the resources below, hopefully, they will help you. And if this video was helpful, click like, subscribe to my channel.

Cheers.

Video transcript

Hi, Kerry here from My Cloud Bookkeeping, I work with small businesses and entrepreneurs to help them to keep their records in order using QuickBooks Online. So they can make their sales tax payments on time, understand their business, have reports that help them manage their cash flow or on a regular basis. And today we're going to talk about the really, really important function of reconciling. We're going to walk through the example of reconciling a credit card, but the same thing counts for reconciling your bank account. And what reconciling does is it make sure on a regular basis that your records agree to the bank's records. Now, what we're assuming is that what the bank has is correct, and we're comparing it into QuickBooks and that's very important. We don't want to be going the other way. So we're going to obtain a statement to compare to QuickBooks. Some of the reasons why the records might be different other than the bank error, we'll assume the bank has not made an error, is if you've added things from the bank feed—your connection to bank from the bank to QuickBooks twice, that happens a lot. I call them duplicated transactions. If you do have a problem with that, check the link below, it can be quite time-consuming to clean up and I've created a course to help with that.

So that can be one of the ways that things go wrong. Another thing is, if you're using expense capture software, such as Hubdoc or receipt bank, sometimes it comes in one way, and then you enter it another. So you've got something sitting here, it's unpaid, but you have an expense you've added here. Just things can get messed up. And when you're doing your reconciliation, as you'll see, when we move into the steps, you're able to select the items that are on the statement and see if there's anything leftover. Because, if you think about it, if you've added something from software and you've added it from your bank feed, it's going to be in twice. Your profit number won't be correct. Your expenses will look too high and you can't make good decisions because you don't actually know how much money you owe on that credit card. So let's have a look and walk through the steps now.

Before you reconcile, it's always important to make sure you've dealt with all of the items that are showing up on the bank feed. Because if you have things here that you have not yet recorded, obviously your records won't be complete, you won't have things to reconcile. I do have checklist. It'll be in the downloads, it's something about add-on steps to take before you do your reconciliation or something. Check that out.

So now that we're here, we have a number of different options to get to reconcile. We can click here and choose reconcile. We can pop up here and choose reconcile, or I don't know why this is my favourite, I always pop into the register and click reconcile here. So the first thing you're going to want to do is have a look at your statement and make sure that the beginning balance agrees. So this here is the statement balance from the 31st of July, it will be the opening balance on the statement you look at now. Now, often credit card statements They don't have a nice clean month, they may be to be the 5th of August to the 6th of September or something like that. But just make sure that whatever the beginning balance is, agrees to the opening balance on the statement that you're looking at. I hope that makes sense. So then you want to read the closing balance on the statement you have. So I've done that with my statement and mine is always also at the end of the month because it's not real, we're in the fake company. So I'm going to click ‘start reconciling’ and here's what's happened. It's popped in and it's decided that everything that's green here that's come from the bank feed is correct and everything that hasn't is not. And I can very easily see how to fix this $1,000 difference. I click this right here, but that doesn't really help us with our exercise because imagine if we've got, I don't know, 50 or 100 transactions here.

So I would be happy now if this was me, but if it was a larger exercise and I didn't really know what was going on, I would put a checkmark here. I would select everything. And then I'd put a checkmark here to unselect everything or de-select everything. The reason I do that is there could be items like this hiding on another page. So you might think you're starting clean, but you're not actually. So if you're going to got hrough the process where it doesn't agree, when you very first open this, then this is the way I would make sure I was doing that. So I would then look at my statement. I'm going to look at my statement and see the payment of $1,000. Not sure why that wasn't on the bank feed, but anyway, I'm looking at my statement and I'm seeing this one. I'm looking at my statement, I'm seeing this. Looking at my statement, seeing this. So notice we're going from the statement to QuickBooks, not the other way around. And here we go here.

Now, what do I have here? I have a credit card credit on the 30th of August that for some reason has not gone through yet. And then I have a purchase on the 31st of August. Now, when these items do show up on the bank feed, they should match. And it does make sense, perhaps this is a weekend and the items haven't been posted yet. Whatever you have unreconciled items, just, just look at them, do they make sense? Is it old? Like for example, if this, here was dated the 30th of July, I would treat it very differently. I would either be following up to see why I didn't get my credit, or I would be wondering if I've entered it twice or made a mistake. So anything that's white and hasn't been included in there, the reconciliation is normally, it's always something you want to consider why, and it might besomething that requires further action, but here it's just simply near the end of the statement date. If it doesn't clear next month, then I'll be concerned. Now, if you do have a lot of old white items there, it's important you do investigate them because they're making your results in accurate.

For example, here this $156 for utilities. If this never comes through on the credit card, then maybe I've recorded it twice and maybe it's $1,500. It could be anything and it's overstating your expenses. So anything that doesn't clear does need to be looked at, and that's extremely important. Some people get to zero here, and they're super excited. And then they have just lines and lines and lines of items are unreconciled and they're recorded as expenses, so their credit card balance is wrong, but also their expenses are incorrect. And I do have a course for finding and fixing duplicated transactions because it is the most common error I see. So if that's a problem for you, check that out, there should be a link below. And if you've got this all done and it's so beautiful, that's fantastic. You can click finish now, and it's all done.

So, as I mentioned earlier, there is a course for if you have doubled up transactions, which hopefully you don't. I also have some free downloads. There's a checklist of what to do before you do your reconciliation. I have some other things on matching from the bank feed.

So check out the resources below, hopefully, they will help you. And if this video was helpful, click like, subscribe to my channel.

Cheers.

Still need help?

Check this out.

Reconciling Your Credit Card in QuickBooks Online

Why reconciling your credit card in QuickBooks Online on a regular basis is extremely important.

Let's go!Still need help?

We have what you need. Check out our courses and free resources to get more help managing your finances.

Let's go!.png)